How Did Your FSA Do In 2016?

Happy 2017 folks!

Well, the end of 2016 (and the end of my FSA benefits year) has come and gone, and I recently reviewed my 2016 FSA account to see how I did. Did I burn down all of my FSA? Did I maximize my savings/income? Or did I leave a bunch of pre-tax dollars on the table? Let’s see:

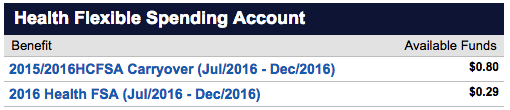

Here’s a screenshot of my FSA administrator’s website (CONEXIS):

You see two accounts for the same time period (which is only a half-year because my employer is resetting our benefit year to start in January instead of July) because I had some left-over FSA balance from the previous 2015 year that was carried-over (see your FSA administrator to see if your employer allows this. Mine carried-over up to $500 of unused balance towards the following year!)

Anyway, I left a total of $1.09 on the table in 2016. Not bad! After getting disposable contacts, Warby Parker glasses, a bunch of dental, vision, and medical co-pays later, I used up all but $1.09. This makes me feel pretty good about actually taking advantage of the benefits that my employer gives to me in the form FSA, or health flex-spending.

I hope you did a good job in spending your FSA dollars to ultimately save on your hard-earned pre-tax income. If you still have a size-able balance, check if you have receipts left over from 2016. It’s likely that your FSA-administrator still allows you to claim reimbursements into 2017. And if not, check if any of your balance can be carried-over into 2017.

Most of all, be vigilant about using your FSA in 2017!

Previous Post

Previous Post Next Post

Next Post